The ESG disclosure framework in India, focusing on the BRSR Core, is the mandated reporting guideline that forms the basis of the prevailing ESG system. The CRISIL rating dated (2023) is used as the data source to analyze ESG performance at both individual and sectoral levels. India's journey towards sustainable business practices, encapsulated by ESG principles, has been significant, with the Ministry of Corporate Affairs (MCA) first issuing the Voluntary Guidelines on Corporate Social Responsibility in 2009. The reporting landscape has advanced significantly with the introduction of Business Responsibility Reporting (BRR), Corporate Social Responsibility (CSR), IR, National Guidelines on Responsible Business Conduct (NGRBC), and now the Business Responsibility and Sustainability Report (BRSR). The 21st century has witnessed a surge in interest in ESG, driven by regulatory mandates and corporate initiatives. Key milestones include the Companies Act, 2013 Section 135 on CSR, Section 134, sub-section 3, Clause (m) on energy saving details, and the CRISIL rating (2023).

The Securities and Exchange Board of India (SEBI) has amended LODR Regulations 2015, specifically Regulation 34(2)(f), specifying ESG details to be included in the annual report. The requirement is to furnish 'Environmental, Social and Governance' disclosures known as the 'Business Responsibility and Sustainability Report' (BRSR) in the specified format. The BRSR framework, modelled in line with National Guidelines on Responsible Business Conduct (NGRBC) and internationally recognized reporting frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI), emphasizes comprehensive disclosures on ESG factors, including governance, ethics, social responsibility, environmental performance, and economic performance. The BRSR Core is a subset of the BRSR, comprising a collection of Key Performance Indicators (KPIs) and metrics under nine ESG criteria. Additional KPIs, such as the creation of jobs in small towns, corporate transparency, and gross wages paid to women, have been identified for assurance in light of the Indian and emerging market setting. The BRSR Core aims to establish quantifiable and standardized ESG disclosures, enabling investors to make better investment selections and encourage businesses to consider social and environmental effects in addition to financial ones.

The BRSR Core, introduced by SEBI, aims to provide assurance for listed entities and include disclosures and assurance for the value chain of listed entities. The top 1000 listed companies by market capitalisation must also disclose information using the new BRSR format. The circular mandates that the top 250 listed businesses by market capitalization use a comply-or-explain approach to report BRSR Core information for their value chain in their FY24-25 Annual Reports. The report should include 75% of the entity's purchases or sales by value, including significant upstream and downstream partners, disclosing through KPIs in the BRSR Core for their value chain. This requirement has a cascading impact, raising awareness of ESG issues beyond listed companies. The reporting structure of BRSR consists of three sections: General Disclosures, Management and processes, and Principle-wise performance. The General Disclosures section provides basic information about the listed entity, while Management and Process Disclosures focuses on the company's policies and procedures pertaining to the NGRBC principles of stakeholder engagement, governance, and leadership. Principle-wise performance disclosures require companies to demonstrate their intention and commitment to conducting business responsibly by their actions and outcomes.

The BRSR Core, a subset of the BRSR framework, provides a comprehensive view of a company's operations in terms of sustainability. It includes disclosures on governance, environment, social, customer and product responsibility, human capital, supply chain, and stakeholder engagement. The BRSR framework also includes Key Performance Indicators (KPIs) and metrics grouped under nine ESG criteria, including greenhouse gas (GHG) footprint, water footprint, energy footprint, circularity and waste management, employee well-being and safety, gender diversity, inclusive development, customer and supplier engagement, and openness of business.

The BRSR framework provides a firm structure for ESG reporting, with BRSR Core providing essential KPSs. It is crucial to examine ESG performance achieved across various industry sectors to assess the extent to which SEBI's efforts have succeeded in achieving the desired goal. The BRSR framework has provided a firm structure for ESG reporting, with BRSR Core providing essential KPSs.

CRISIL ESG Rating is a data source used to analyze and understand the ESG scenario in India, particularly for those making disclosures regarding ESG. The CRISIL methodology assesses 600+ KPIs across sectors using publicly accessible information and other relevant ESG information from credible sources. The evaluation framework comprises 275 assessment parameters and 500+ data points across E, S, and G.

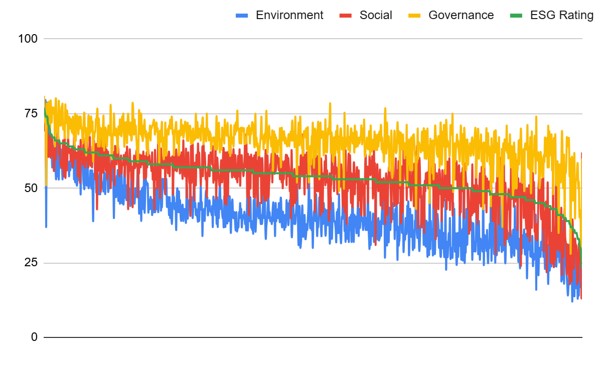

The CRISIL ESG rating scores provide an overall picture of ESG status in India, with an average ESG rating score of 53.4 (out of 100). However, there is a large scope for improvement. The Environment factor has the lowest mean score of 40.5, which can be considered as 'Below Average,' keeping with the established categorisation. The Social factor can be regarded as 'Adequate' with a mean score of 52.6. Companies performed better in the Governance factor with a mean score of 65. Historically, governance has been given more attention than the other two factors, reflected in better performance.

The top performing companies are "Leadership," with an ESG score of 71 to 100. Nine companies managed to get into the category with ratings ranging between 71 and 77, but there is scope for improvement for them. An interesting observation is that these companies belong either to 'IT' (7) or to 'Banks' (2).

The higher the ESG rating, the less the divergence between the E, S, & G scores. High performers have better scores in all three factors, though they have to improve their ESG performance to face the world market. Comparatively, Banks score high on Governance but the edge is lost in the Social factor, hinting a scope to improve their rating considerably by paying more attention to social performance.

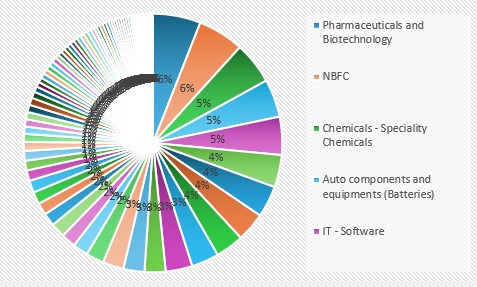

Figure 1 Sectoral Distribution Source: CRISIL ESG Ratings

CRISIL's Environmental and Social Rating Index (ESG) reveals that banks, IT, and NBFC are the top performing sectors in terms of ESG ratings. The highest mean score for all three factors and ESG rating is found in banks, followed by IT with second-best scores in E, G, and ESG ratings. Insurance, Auto OEMs, NBFC, and Healthcare are the lowest performing sectors.

The higher the ESG rating, the less the divergence between E, S, and G scores. However, the divergence between E, S & G seems to increase as the overall ESG rating increases. Major industry sectors rated by CRISIL, those with more than 10 companies, are selected for a comparative analysis of their performance.

Figure 2 ESG Factor-wise Divergence Source: CRISIL ESG Ratings

Most of the sectors have a mean social score above 51, with 16 out of 27 falling into the category of Below Average. Banks, Healthcare, and Auto OEMs rank high on the Social factor, closely followed by Auto components, IT, Metals, Pharmaceuticals and Biotechnology, Oil & Gas, etc.

All sectors performed well in Governance with scores above 60, except Paper, which has a dismally low average score of 38. Banks and IT sectors secured a high average score of 70, just missing the Leadership category by a whisker. Sectors performing well in the 'Environment and Social' were noticed to have a higher governance score and vice versa, which is reflected in the ESG rating.

ESG ratings can significantly enhance a company's brand reputation by highlighting its sustainability practices, effective management of public concerns, and adherence to ethical standards. A high ESG rating can differentiate a company from its rivals and garner positive media attention and recognition from sustainability indices. Benefits of having a high ESG rating include added value creation, stronger brand positioning, access to more capital, financial risks reduction, social license to operate, acquisition and retention of top talent, and market access and market share increase.

The BRSR Core, a component of the BRSR framework established by SEBI in 2023, serves as a guideline for firms to assess their ESG performance. It encompasses disclosures and assurance for the value chain of publicly traded firms, focusing on governance, environment, social responsibility, customer and product accountability, human capital, supply chain, and stakeholder engagement.

The CRISIL ESG Rating offers an extensive overview of ESG ratings and scores for 986 companies across 88 sectors in India. The mean ESG rating score is 53.4, indicating that governmental and regulatory bodies are advancing in their ESG initiatives. However, there is still potential for enhancement, with the environmental impact of office-based firms being less visible compared to other industries.

Investors value businesses that incorporate sustainability into their operations, leading to increased value creation and stronger brand positioning. This also allows businesses to access more capital, as investors are key users of ESG performance data. ESG reporting helps businesses gain a social license to operate, gaining the support of communities and encouraging the acquisition and retention of top talent.

References

- Annexure I - Format of BRSR Core: https://www.sebi.gov.in/sebi_data/commondocs/jul-2023/Annexure_I-Format-of-BRSR-Core_p.pdf

- Balanced Framework for ESG Disclosures, Ratings and Investing; https://www.sebi.gov.in/sebi_data/meetingfiles/apr-2023/1681703013916_1.pdf

- BRSR Core - Framework for assurance and ESG disclosures for value chain: https://www.sebi.gov.in/legal/circulars/jul-2023/brsr-core-framework-for-assurance-and-esg-disclosures-for-value-chain_73854.html

- BRSR Core: New guidelines around assurance - https://www2.deloitte.com/content/dam/Deloitte/in/Documents/audit/in-audit-Business-Responsibility-and-Sustainability-Report-Core_10-11-2023.pdf

- CRISIL ESG Ratings; https://www.crisilesg.com/en/home/esg-ratings.html

- CRISIL’s ESG scoring methodology, November 2023

- The Companies Act, 2013: https://www.mca.gov.in/Ministry/pdf/CompaniesAct2013.pdf

Title photo courtesy: pexels.com

Copyright © 2025. Rajagiri Business School. All Rights Reserved. Website Designed and Maintained by Intersmart